9

Pension scheme contributions

Employer contributions to a registered employer pension

scheme or your own personal pension policies are not liable for

tax or NICs.

Please be aware that while your employer can contribute to your

personal pension scheme, these contributions are combined

with your own for the purpose of measuring your total pension

input against the ‘annual allowance’. Further information is

provided in this guide.

Deductions for travel and subsistence

Site-based employees may be able to claim a deduction for

travel to and from the site at which they are working, plus

subsistence costs when they stay at or near the site.

Employees working away from their normal place of work

can claim a deduction for the cost of travel to and from their

temporary place of work, subject to a maximum period.

Approved business mileage allowances – own vehicle

Vehicle

First 10,000 miles Thereafter

Car/van

45p

25p

Motorcycle

24p

24p

Bicycle

20p

20p

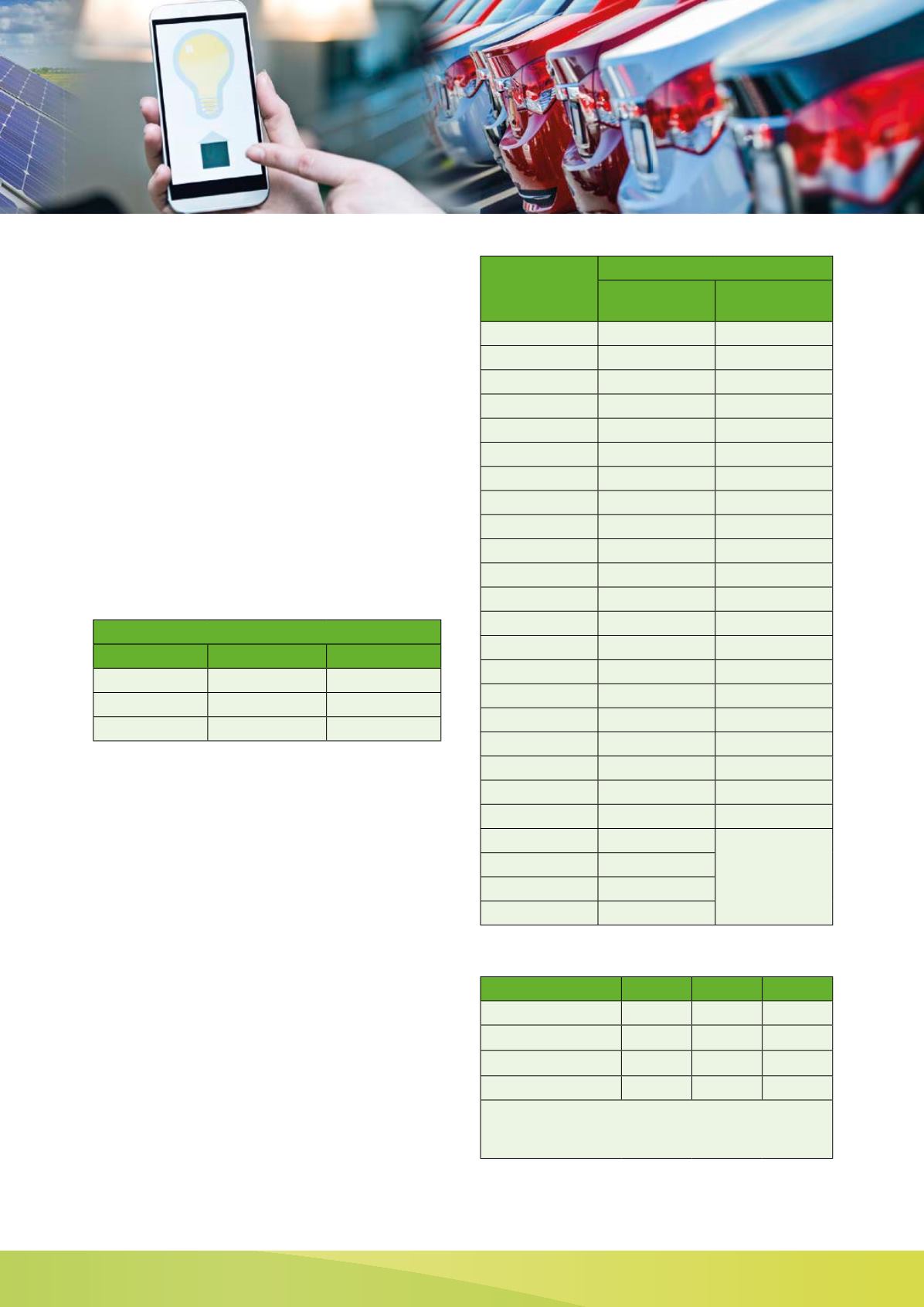

Company cars

The company car continues to be an important part of the

remuneration package for many employees, despite the

increases in the taxable benefit rates over the last few years.

Employees and directors pay tax on the provision of the car

and on the provision of fuel by employers for private mileage.

Employers pay Class 1A NICs at 13.8% on the same amount.

This is payable by the 19 July following the end of the tax year.

The amount on which tax and Class 1A NICs are paid in respect

of a company car depends on a number of factors. Essentially,

the amount charged is calculated by multiplying the list price

of the car, including most accessories, by a percentage. The

percentage is set by reference to the rate at which the car emits

CO

2

– please see the table to the right.

Pooling your resources

Some employers find it convenient to have one or more cars

that are readily available for business use by a number of

employees. The cars are only available for genuine business

use and are not allocated to any one employee. Such cars are

usually known as pool cars. The definition of a pool car is very

restrictive, but if a car qualifies there is no tax or NIC liability.

CO

2

emissions

(g/km)

Appropriate percentage

Petrol

%

Diesel

%

0 - 50

7

10

51 - 75

11

14

76 - 94

15

18

95 – 99

16

19

100 – 104

17

20

105 – 109

18

21

110 – 114

19

22

115 – 119

20

23

120 – 124

21

24

125 – 129

22

25

130 – 134

23

26

135 – 139

24

27

140 – 144

25

28

145 – 149

26

29

150 – 154

27

30

155 – 159

28

31

160 – 164

29

32

165 – 169

30

33

170 – 174

31

34

175 – 179

32

35

180 – 184

33

36

185 – 189

34

37

190 – 194

35

195 – 199

36

200 and above

37

Car – fuel only advisory rates

Engine capacity

Petrol

Diesel

Gas

Up to 1400cc

10p

8p

7p

1401cc - 1600cc

12p

8p

1601cc to 2000cc

10p

Over 2000cc

19p

11p

13p

Rates from 1 March 2016 and are subject to change. Note the

advisory fuel rates are revised in March, June, September and

December. Please contact us for any updated rates.